Explore November's market highlights: S&P 500 rallies, Bitcoin surges 37%, currency shifts, and global macro trends shaping 2024's investment landscape.

Global Equities: A November to Remember

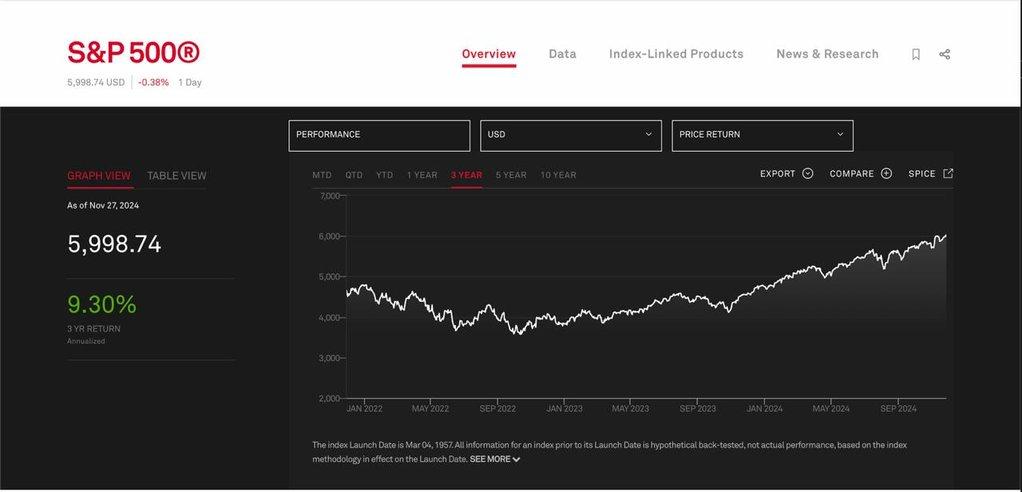

US equity markets are ending November on a high note, with the S&P 500 poised for its strongest month since February. Tech giants continue to dominate, with Nvidia’s stock tripling in value this year, helping propel the S&P 500 and Nasdaq 100 to gains exceeding 20% for 2024. Despite early-year concerns about a hard economic landing, resilient growth, robust corporate earnings, and easing inflation have defied expectations.

In China, equities rallied this week as investors anticipate fresh economic support from December’s key policy meetings. Conversely, Europe faces challenges, with the euro posting its worst month in over a year, hampered by slow growth and fiscal uncertainty in France.

Key Takeaway: While US equities shine, global markets remain mixed. Diversification remains critical for managing exposure across geographies.

Currency Markets: A Mixed Bag

The US dollar logged its biggest weekly loss in three months, reflecting a re-evaluation of investor sentiment. In Japan, the yen breached the psychologically significant 150 mark against the dollar, with expectations of higher interest rates following stronger-than-expected inflation. The euro, on the other hand, continues to struggle, weighed down by stagnant growth and political uncertainty in France.

For Investors: Currency markets are poised for volatility in 2025, with potential opportunities in currency trading as global macroeconomic policies evolve.

Cryptocurrency: Bitcoin Shines Again

Bitcoin saw a dramatic 37% rally this month, reaffirming its status as a speculative favorite during market optimism. Its trajectory mirrors past bull runs, albeit with more pronounced price swings. While crypto enthusiasts view the rally as a sign of renewed market confidence, skeptics warn of potential corrections.

Investor Insight: Bitcoin’s surge reflects speculative enthusiasm, but its inherent volatility demands caution. Long-term investors should focus on risk management.

Fixed Income: Bond Market Dynamics

French bond yields rose to levels comparable to Greece’s, signaling investor unease over fiscal challenges. Meanwhile, US corporate bonds remain a bright spot for income-focused investors as yields stay elevated. On the central bank front, Wall Street expects the Federal Reserve to ease its pace of interest rate cuts in 2025, aligning with a “soft landing” strategy to balance inflation control with economic stability.

What It Means: Bond markets offer a mix of risks and opportunities. High-yield corporate bonds may appeal to income seekers, but vigilance is essential amid geopolitical and fiscal uncertainties.

Macro Trading: A Tough Year for Some

2024 has been a challenging year for macro traders, with revenues from interest rates and foreign exchange trading dropping significantly. Banks are projected to earn $32 billion from rates and $16.7 billion from currencies, marking sharp declines from the previous year. This slump reflects tighter margins and diminished confidence in making bold macroeconomic predictions.

The Outlook: While macro trading remains subdued, currency markets could rebound in 2025 as policy changes and geopolitical shifts drive volatility.

A Buffett Warning Revisited

The US stock market’s capitalization has soared to $62 trillion, more than double the size of the US economy. This level is reminiscent of the dot-com bubble era, prompting comparisons to Warren Buffett’s 2001 cautionary note about market cap-to-GDP ratios exceeding 200%. Notably, Berkshire Hathaway’s record $325 billion in cash holdings underscores a preference for caution.

Investor Reflection: Overvaluation signals should not be ignored. Long-term investors might consider balancing equity exposure with defensive assets.

Global Geopolitics and Energy Markets

Geopolitical developments continue to shape market sentiment. In the Middle East, a ceasefire between Hezbollah and Israel has provided temporary relief but highlights ongoing regional instability. Energy markets, while steady, face potential disruptions from shifting OPEC+ priorities and geopolitical tensions.

For Energy Investors: Structural changes in market fundamentals warrant close monitoring. Long-term plays in energy transition technologies may offer growth opportunities.

Emerging Markets: Mixed Fortunes

Brazilian markets are under pressure, with stocks experiencing their largest drop since May 2023 and the real hitting record lows. However, South Africa presents a brighter picture. Strategists suggest that its relative insulation from geopolitical risks and inflationary pressures could position it as an outperformer among emerging markets in 2025.

Investor Strategy: Emerging markets are not homogeneous. Selective exposure based on local economic dynamics and geopolitical risks is crucial.

Cryptic Cars and Tariff Troubles

Tariff threats loom large over global automakers, with potential cost implications of up to 17% of core profits. Premium brands like Volvo and Jaguar Land Rover could face significant margin pressures. Additionally, tighter EU emissions regulations and increased competition in China compound the challenges.

What’s Next: Investors in automotive stocks should be mindful of regulatory and geopolitical headwinds.

Author’s Analysis: Navigating 2024’s Lessons

2024 has demonstrated the unpredictability of markets, from equity rallies and Bitcoin surges to struggles in macro trading. The year underscores the importance of diversification, discipline, and a focus on fundamentals.

For equity investors, the US market remains a leader, but valuations warrant caution. Bond markets offer income opportunities amid geopolitical risks, while cryptocurrencies reflect speculative sentiment. Emerging markets and energy sectors hold promise, but careful selection is key.

Final Word: Stay informed, stay diversified, and prioritize long-term growth strategies. Markets may evolve rapidly, but disciplined investing remains a timeless principle.

Protect and Grow Your Wealth

Wondering how to navigate these complexities and safeguard your wealth? Subscribe to the EstimatedStocks Model Portfolio for free at https://estimatedstocks.com/sign-in to receive market-beating stock picks and updates on US corporate bonds.

Disclaimer:

The information provided in this article is for educational purposes only and should not be construed as investment advice. estima...

Author

Shaik K is an expert in financial markets, a seasoned trader, and investor with over two decades of experience. As the CEO of a leading fintech company, he has a proven track record in financial products research and developing technology-driven solutions. His extensive knowledge of market dynamics and innovative strategies positions him at the forefront of the fintech industry, driving growth and innovation in financial services.